Calculating the accounting rate of return conventionally is a tiring task so using a calculator is preferred to manual estimation. If you choose to complete manual calculations to calculate the ARR it is important to pay attention to detail and keep your calculations accurate. If your manual calculations go even the slightest bit wrong, your ARR calculation will be wrong and you may decide about an investment or loan based on the wrong information. Hence using a calculator helps you omit the possibility of error to almost zero and enable you to do quick and easy calculations. Using the ARR calculator can also help to validate your manual account calculations.

Real Rate of Return vs. Nominal Rate of Return

For those new to ARR or who want to refresh their memory, we have created a short video which cover the calculation of ARR and considerations when making ARR calculations. If you’re making long-term investments, it’s important that you have a healthy cash flow to deal with any unforeseen events. Find out how GoCardless can help you with ad hoc payments or recurring payments. Another advantage is that the ARR method considers the entire lifespan of the investment.

Depreciation Calculators

- Along with profits, firms are now equally concerned about the costs they have to pay on a daily basis.

- Accounting rate of return (also known as simple rate of return) is the ratio of estimated accounting profit of a project to the average investment made in the project.

- Calculate the denominator Look in the question to see which definition of investment is to be used.

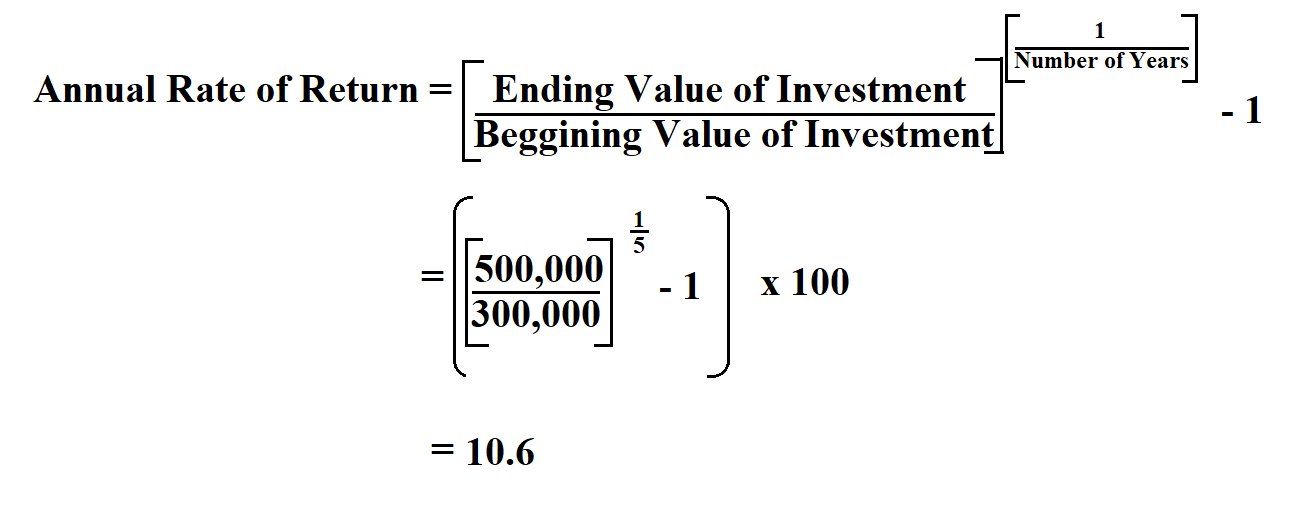

The Internal Rate of Return (IRR) and the Compound Annual Growth Rate (CAGR) are good alternatives to RoR. IRR is the discount rate that makes the net present value of all cash flows equal to zero. CAGR refers to the annual growth rate of an investment taking into account the effect of compound interest. To find this, the profit for the whole project needs to be calculated, which is then divided by the number of years for which the project is running (in this case five years). What’s more, the technique simply omits real cash flows and focuses on profits only.

Loan Calculators

This means that for every dollar invested, the project will return a profit of about 4 cents. The main difference is that IRR is a discounted cash flow formula, while ARR is a non-discounted cash flow formula. However, in the general sense, what would constitute a “good” rate of return varies between investors, may differ according to individual circumstances, and may also differ according to investment goals. Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

Real Rate of Return vs. Compound Annual Growth Rate (CAGR)

On the other hand, consider an investor that pays $1,000 for a $1,000 par value 5% coupon bond. If the investor sells the bond for $1,100 in premium value and earns $100 in total interest, the investor’s rate of return is the $100 gain on the sale, plus $100 interest income divided by the $1,000 initial cost, or 20%. The Accounting Rate of Return, unlike the NPV and IRR, is not based on real cash flows and market value.

The new machine will cost them around $5,200,000, and by investing in this, it would increase their annual revenue or annual sales by $900,000. Specialized staff would be required whose estimated wages would be $300,000 annually. The estimated life of the machine is of 15 years, and it shall have a $500,000 salvage value. Accounting Rates of Return are one of the most common tools used to determine an investment’s profitability. It can be used in many industries and businesses, including non-profits and governmental agencies. The rate of return, or RoR, is the net gain or loss on an investment over a period of time.

Investment evaluation, capital budgeting, and financial analysis are all areas where ARR has a strong foundation. Its adaptability makes it useful for a wide range of applications, including assessing the economic profitability of projects, benchmarking performance, and improving resource allocation. A rate of return (RoR) can be applied to any investment vehicle, from real estate to bonds, stocks, and fine art. The RoR works with any asset provided the asset is purchased at one point in time and produces cash flow at some point in the future.

It can help a business define if it has enough cash, loans or assets to keep the day to day operations going or to improve/add facilities to eventually become more profitable. Accounting Rate of Return (ARR) is a formula used to calculate the net income expected from an investment or asset compared to the initial cost of investment. Imagine a company tax returns 2021 is considering a project with a $50,000 initial investment and expected to generate profits of $10,000 in year 1, $12,000 in year 2, and $8,000 in year 3. However, the formula doesn’t take the cash flow of a project or investment into account. It should therefore always be used alongside other metrics to get a more rounded and accurate picture.

Calculating the denominator Now we have the numerator, we need to consider the denominator, i.e. the investment figure. At the end of the day, using the AAR technique allows managers to understand quickly whether an investment opportunity is lucrative enough to justify making a further evaluation. As a rule, this measure is recommended to be applied in combination with others.

Every business tries to save money and further invest to generate more money and establish/sustain business growth. For example, if your business needs to decide whether to continue with a particular investment, whether it’s a project or an acquisition, an ARR calculation can help to determine whether going ahead is the right move. Candidates need to be able to calculate the accounting rate of return, and assess its usefulness as an investment appraisal method. A company is considering in investing a project which requires an initial investment in a machine of $40,000. Net cash inflows of $15,000 will be generated for each of the first two years, $5,000 in each of years three and four and $35,000 in year five, after which time the machine will be sold for $5,000. Furthermore, the ARR percentage is sensitive to the accounting choices companies make.

However, the formula does not consider the cash flows of an investment or project or the overall timeline of return, which determines the entire value of an investment or project. This simple rate of return is sometimes called the basic growth rate, or alternatively, return on investment (ROI). Average accounting profit is the arithmetic mean of accounting income expected to be earned during each year of the project’s life time.